Courtesy of First National Financial – one of Canada’s leading lenders, Commercial & Residential

The Budget

The federal budget included material spending increases for housing, defense and indigenous programs mostly offset by a higher capital gains tax. Too bad for all those suckers that bought NVIDIA stock last year. Now their massive capital gains will now attract 67% of their marginal tax rate (vs. 50%)! Overall, the deficit for fiscal year 24/25 was little changed and the 5-year profile was $10 billion higher than projected in the fall economic statement.

Some housing specific items include:

Rule changes:

- Increase apartment CCA from 4% to 10% on eligible new purpose-built rental projects beginning construction between April 2024 and January 2031.

- Launch of Secondary Suite Loan Program enabling homeowners access to up to $40,000 in low-interest loans to add a secondary suite to their homes.

- Incentives to Encourage Densification (converting houses to triplex, secondary suite, etc.) by creating new opportunities for homeowners with, amongst other things, an increase in the applicable insured mortgage limit.

- Extension of First-Time Buyers Mortgage Amortization to 30yr (from 25yr) starting August 1, 2024.

- Increase RRSP HBP limit to $60,000 (from $35,000) effective April 16, 2024.

- Extension of the Grace Period to Repay RRSP Withdrawals by an additional three years for withdrawals between January 2022 and December 2025.

- Extension of the Foreign Homebuyers Ban until January 2027.

Funding:

- Additional $15B for the Apartment Construction Loan Program which provides low-cost repayable loans to builders and developers.

- Additional $1B to the Affordable Housing Fund which provides low-interest or forgivable loans for affordable housing.

- Additional $400mm to the Housing Accelerator Fund (currently $4B) to incentivize zoning removal and speed up permitting.

- Launch of a $6B new Canada Housing Infrastructure Fund to accelerate the construction and upgrading of critical housing infrastructure.

- Launch of a $1.5B new Canada Rental Protection Fund to acquire affordable rental units at risk of being sold to investors.

Others:

- The creation of a New Canadian Renters’ Bill of Rights

- The launch of the Canada Builds initiative

- The launch of Public Lands for Homes plans

Find the full Canada Housing Plan at: https://www.infrastructure.gc.ca/housing-logement/housing-plan-report-rapport-plan-logement-eng.html

Housing market

Home sales edged up 0.5% in March compared to February for a third month-over-month increase in the last four months. Active listings also edged up by 0.5%, leaving the listings to sales ratio unchanged at 3.8. On a year-over-year basis, home sales were up 1.7%.

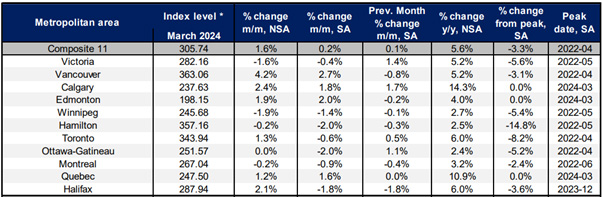

The Teranet-National Bank composite House Price Index rose by 0.2% (seasonally adjusted) led by Vancouver (+2.7%) and moderated by Montreal (-0.9%) and Toronto (-0.6%). The composite index is now down 3.3% from peak set in April of 2022. The table below shows HPI stats for various metropolitan areas. Note how the change from peak prices is different across regions.

According to Statistics Canada, Canadian Mortgage credit was up 3.4% year-over-year in February, little changed from the prior month. This is a notable slowdown from the double-digit growth rates seen during the low-rate period of the pandemic. Still, even this more modest growth in credit is evidence of a stable housing market.

Looking ahead, strong demographic growth, low vacancy rates and a central bank poised to cut rates should provide a constructive foundation (no pun intended) for housing activity in the coming months.

Gold-because no one asked…

Police arrested six people this week in a multijurisdictional investigation into the theft of $20 million in gold bars at Toronto Pearson Airport. Warrants have been issued for others, including Air Canada employees. Unfortunately, the culprits did NOT use modified Minis to make a getaway through TTC subway tunnels.

In the meantime, the spot price of gold is reaching new all-time heights, trading at $2,375. Good news for gold holders…except for the new capital gains tax.