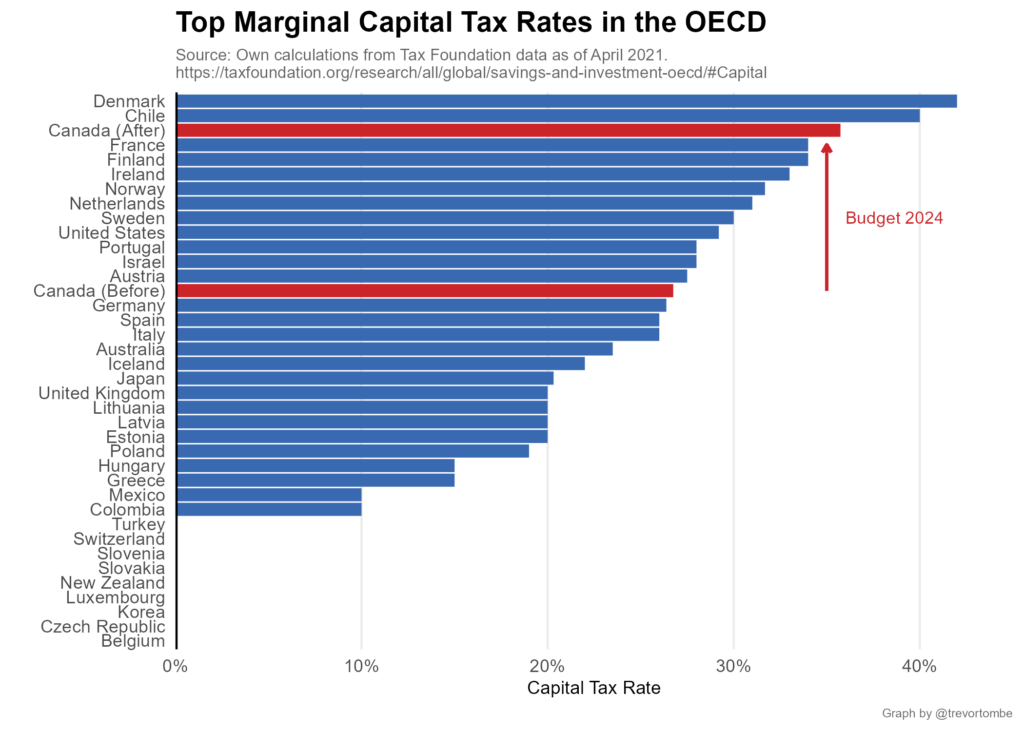

Canada’s Capital Tax Ranking Before & After April 2024 Federal Budget.

This makes you wonder if Investors will begin to look elsewhere, as they have in the past when tax rate changes have been made unfavorable in Canada, or more favorable in the US.

Canada’s Capital Tax Ranking Before & After April 2024 Federal Budget. Read More »