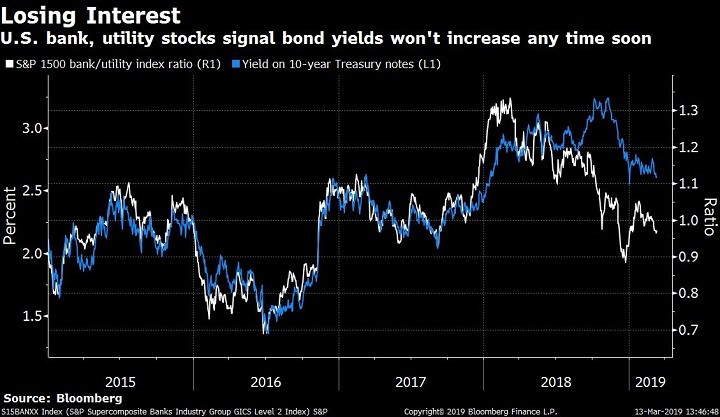

David Wilson, Stocks Editor, Bloomberg Radio has shown a great chart here that further indicates the lack of upward pressure on interest rates. Renaissance Macro Research LLC created by Michael Guttag, a managing director, Yesterday March 12, 2019. Guttag compared a ratio of bank and utility stocks within the S&P 1500 Composite Index — consisting of all the shares in the S&P 500, MidCap 400 and SmallCap 600 indexes — with the yield on 10-year Treasury notes. The correlation indicates a downward direction in interests. Per David Wilson: The ratio peaked in March of last year and then dropped 28 percent through Tuesday. “We’re not banking on higher yields,” Renaissance wrote.